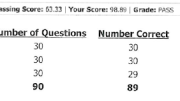

Well, look at that. I am a competent manager when it comes to Global Economics. I’ll be honest it was more difficult than I was expecting. But I passed and now it is on to the accounting course. Now that should be some exciting reading.

The Global Economics for Managers course is part of WGU’s competency-based MBA program. It focuses on applying macroeconomic and microeconomic principles in a global business environment. It explores international trade theory, market structure, and globalization. This prepares managers to making informed global business decisions.

Condensed Exam Study Guide (Fast Review)

Competency 1 — Business Decision‑Making in the Global Environment

Key Ideas

Comparative Advantage: Produce what you’re relatively best at; trade for the rest.

Specialization & Gains from Trade: Countries/firms benefit by specializing.

- Globalization Views (Long‑run, Pendulum, New Force): Integration shifts over time.

- Institution‑Based View vs. Resource‑Based View: Success depends on rules (laws, culture) and unique internal capabilities.

Competency 2 — Political & Economic Forces

Key Ideas

- Political systems: democracy, theocratic, totalitarian. (Common exam topic from student reports.)

- Economic systems: market, command, mixed economies.

- Policy tools: tariffs, trade barriers, government intervention.

Competency 3 — Economic Decision‑Making by Firms & Consumers

Key Ideas

- Indifference Curves & Marginal Rate of Substitution (MRS): Consumer choice theory.

- Cost Curves: Marginal cost, fixed vs. variable costs. If MR > MC → Increase production.

- Market Structures: Perfect competition vs. monopoly vs. oligopoly. Barriers to entry.

Competency 4 — Microeconomic & Macroeconomic Principles

Microeconomics

- Supply & Demand Shifts: How equilibrium price/quantity changes with shocks. (Common OA pattern.)

- Elasticity: Responsiveness to price changes.

Macroeconomics

- Exchange Rates: Interest rate changes influence currency flows.

- Federal Reserve Tools: Open market operations, reserve ratio, discount rate.

- Inflation & Monetary Policy: Buying bonds increases money supply; selling bonds decreases it. (Frequently cited in OA discussions.)

Competency 5 — Global Economic Performance & International Trade

Key Ideas

- FDI (Foreign Direct Investment): Horizontal vs. vertical.

- International Institutions: IMF, WTO roles (general knowledge).

- Exchange Rate Dynamics: Currency appreciation/depreciation impact trade.

- Porter’s Diamond & Global Strategies (Dodger, Defender, Extender, Contender).

Be the first to comment on "Passed Global Economics"